Resurgence Strategies to Navigate Indian Aviation in the Liberalization Saga

Liberalization policies in the aviation sector are intended to achieve high economic growth through the process of globalization and radically improve the infrastructure facilities. However, the policy of liberalization that led to the opening up of the economy has forced the aviation sector to navigate through turbulence. Detailed investigations are carried out on various effects that are consequent to the opening up of the economy, including galloping oil prices; declining seat occupancy; the effects of relaxing the cap on equity; the role of private players in modernization; upgradation and development of the aviation sector, and so on.

The studies revealed that global financial networks started directly influencing imports of crude oil after the Administrative Pricing Mechanism (APM) was dispensed with, thereby increasing state and central levies in the liberalized regime. Further, the emergence of private players during this period adversely affected the national carrier by consistently restricting its seat occupancy even while the private players too were lagging behind adequate Passenger Load Factor (PLF). To effectively tackle these problems the data pertaining to crude oil imports, refining capacity of aviation fuel, and various taxes levied are investigated. The passenger data pertaining to both national and private carriers during the peak period of liberalization when GDP touched its maximum level, are analyzed.

These studies revealed that import duties are levied for entire crude oil imports despite the fact that 50 per cent of the aviation fuel is being exported, while there is no uniform pattern in levying state and central taxes across the country. These findings go on to show that the density of passengers is primarily confined to metro airports with high percentage of load factors leaving a great scope for the development of other operational airports. The various measures that are being taken by the government following economic liberalization are found to be similar to the grand strategies advocated by Glueck, except the combination strategy. However several other miscellaneous measures such as rationalization of tax structures, modifying bilateral treaties and relaxation of mandatory guidelines and regulations are found to be similar to the combination strategy. These findings revealed that generic strategies intended for a business enterprise may be applicable to a Public Sector Undertaking (PSU); and may be reformulated as a resurgence strategy to effectively combat the problems in the Indian aviation sector.

Keywords: Liberalization, passenger load factor, aviation turbine, foreign equity, resurgence strategies.

INTRODUCTION

Aviation in India became a monopoly of the public sector with the enactment of the Air Corporation Act in 1953 and nationalization of the then-existing airlines assets held by J.R.D. Tata. The policy of liberalization introduced in 1991 transformed the socialistic economy to a capitalistic one, and inevitably led the aviation industry to integrate itself with the global society and economy following the deregulation process [1]. Subsequently in 1994 a deliberate policy was implemented to reduce state control over airline operations by allowing market forces to share the airline industry [2]. Consequently, six private airline companies with different fleet sizes were permitted to operate over Indian skies after repealing of the Air Corporation Act. The government of India merged operations of the domestic and international carriers – Indian Airlines and Air India – in 2007. Both the national and private carriers are being supervised by the Airports Authority of India (AAI) under the Ministry of Civil Aviation.

The global recession directly influenced the economic viability of the entire Indian aviation industry due to the high fuel prices, multiple tax structures and downturn in traffic. International Air Transport Association [3] projected a cumulative loss of $1.5 billion for Indian carriers during the recession year 2008, saying that they would post the largest losses outside the US, though no airline in the country declared bankruptcy. According to it, the Indian carriers were likely to account for one in every three dollars of losses in the global airline industry. But the Indian economy showed signs of resilience by the unusual contribution of the service sector [4].

However the budding hopes are from the projections of Centre for Asia Pacific Aviation [5] which predicts that India’s international and domestic traffic will grow by 10 per cent and 20 per cent respectively by the end of the year 2011, taking the overall market to more than 100 million passengers. These figures are reaffirmed by the Planning Commission [6] projections that state that the number of domestic and international passengers would reach about 1,036 lakh and 297 lakh passengers respectively by the end of the eleventh plan period, i.e. 2012, through all operational airports in India.

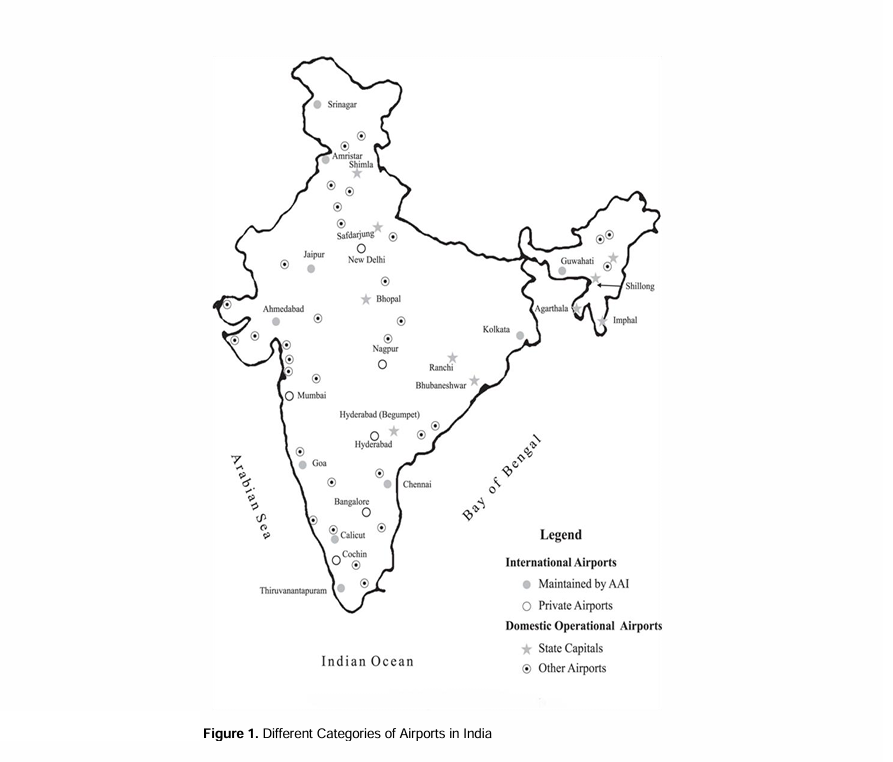

Presently there are 77 operational airports in India out of a total of 125 airports, and both the national and private carriers cover all these operational airports. These airports are classified into international hubs, regional hubs and other operational hubs depending on the extent of the area of operation. Out of the 77 operational airports, 12 are international airports (out of which 7 are metro airports) leaving 48 as non-metro airports and 17 as civil enclaves at military airfields (figure 1).

Presently there are 77 operational airports in India out of a total of 125 airports, and both the national and private carriers cover all these operational airports. These airports are classified into international hubs, regional hubs and other operational hubs depending on the extent of the area of operation. Out of the 77 operational airports, 12 are international airports (out of which 7 are metro airports) leaving 48 as non-metro airports and 17 as civil enclaves at military airfields (figure 1).

Details of national and private carriers, their promoters, fleet size and market share [7] along with year of starting of operations, parent company, head quarters and total destinations covered are investigated in the present study. All these details are codified and presented in

Table 1a. Details of National and Private Carriers along with Destinations Covered and Market Share

| S. No | Airline, Starting Year and Founder | Parent Company and Headquarters | Total Destinations Covered | Market Share (per cent) |

| I | National Carriers NACIL,(2007) | Indian airlines and Air India merged by Govt. of India, Mumbai | 92 | 17.4 |

| II | Private Carriers a. Jet (1992) Naresh Goyal | Tailwinds Limited Mumbai | 76 | 18.2 |

| b. Kingfisher (2003) Vijay Mallya | United Breweries Group Mumbai | 71 | 18.8 | |

| c. IndiGo,(2006) Rahul Bhatia | InterGlobe Enterprise Gurgaon | 31 | 18.7 | |

| d. JetLite, (2007) Subatra Roy | Tailwinds Limited Mumbai | 30 | 8.1 | |

| e. SpiceJet,(2005) Neil Mills | Spice Jet Limited Gurgaon | 29 | 13.4 | |

| f. GoAir (2005) Jahangir Wadia, | Wadia Group Mumbai | 19 | 5.3 |

*Prior to current crisis

table 1a and b. It can be observed from table 1 a and b that the existing fleet size of NACIL is quite small as compared to the private players with coverage of 92 destinations, while the private players have a total of 256 destinations with different fleet sizes. It can be further observed that Jet group comprising Jet Airways, JetKonnect and JetLite covers 106 destinations with a fleet size of 119 aircrafts and had the highest market share of 26.3 per cent in 2011, followed by Kingfisher(*) with 18.8 per cent with a fleet size of 66 aircrafts. Further it is found that the National carrier (NACIL) has 17.4 per cent market share with 126 aircrafts following IndiGo, while SpiceJet and GoAir were lagging behind NACIL. The cascading effects of continuously galloping price of aviation fuel have necessitated systematic investigations for formulating strategies for resurgence of the aviation sector.

Crude Oil, Aviation Fuel and Tax Structures

Crude oil prices in India are directly influenced by international market prices subsequent to the withdrawal of the Administered Pricing Mechanism (APM) in 2002, which was shielding the effect of rise in international oil prices. Though Indian oil reserves are estimated to be approximately 5.6 billion barrels [8], the crude extraction within the country meets only 30 per cent of the domestic requirements. Therefore, India imports 70 per cent of its crude oil requirement, mainly from the twelve developing OPEC nations. The imported crude oil is refined and the Aviation Turbine Fuel (ATF) is supplied through the Public Sector Undertakings (PSUs) such as Indian Oil, Hindustan Petroleum and Bharat Petroleum. These PSUs have a refining capacity of a total 2.1 million barrels per day and have a monopoly in refuelling of the Indian carriers and foreign airlines. The production of crude oil, including imports and consumption of ATF for the years 2004-2010 along with the details of the tax duty, sales tax and service tax are presented in table 2a and b along with details of exports of the aviation fuel from India.